How Much Do You Really Need to Retire? The 4% Rule: Your Shortcut to Financial Independence

By: Felix Diaz, P Eng. |Licensed Financial Advisor

It usually starts with a question.

Just a quiet thought that popped up while doing everyday stuff. Maybe folding laundry, driving home, or watching the kids mess around.

What if retirement wasn’t about age—but about freedom?

For decades, retirement was seen as something reserved for your 60s, after a lifetime of work. But a growing number of people are challenging that idea, asking: “How much do I really need to stop working?” The answer, for many, starts with the 4% Rule.

The Discovery

Scrolling through articles, one of them stumbled across something called the 4% Rule.

It wasn’t flashy. No clickbait. Just a simple formula tucked inside a blog post:

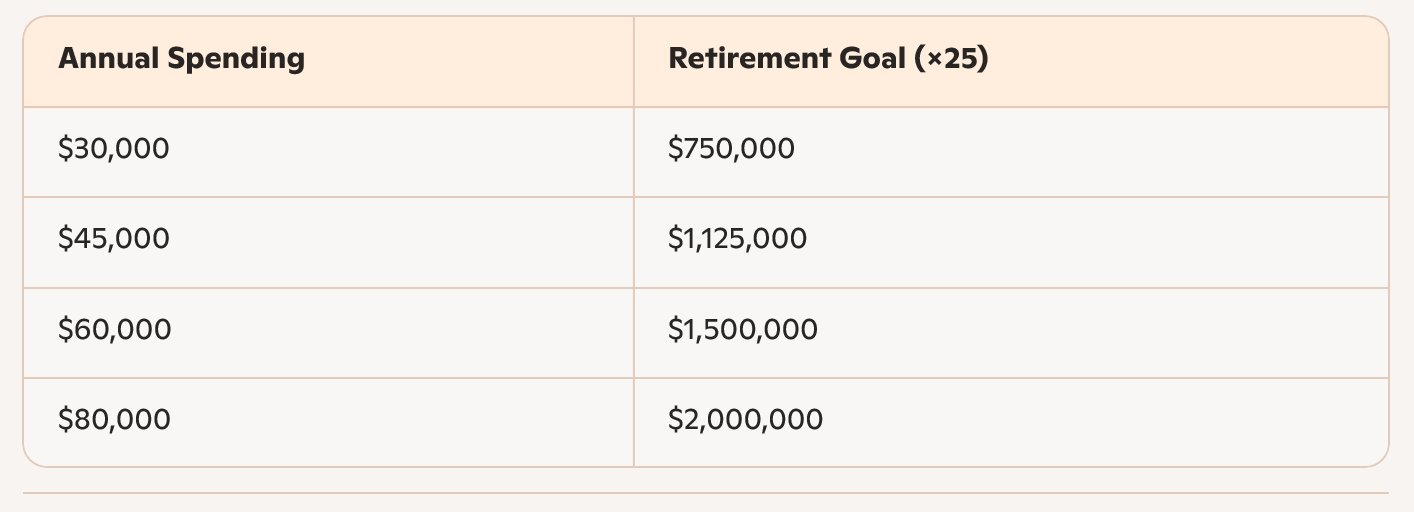

Annual Spending × 25 = Retirement Savings Goal

I paused. Did the math.

If I spend around $45,000 a year. Multiply that by 25, and the number was $1.125 million.

It was a lot—but not impossible. And certainly not the $5 or $10 million they’d always assumed retirement required.

Suddenly, the goal felt real. Tangible. Achievable.

What Is the 4% Rule?

The 4% Rule is a retirement guideline suggesting you can withdraw 4% of your savings in the first year, then adjust that amount for inflation annually. It’s based on the famous Trinity Study, which tested various withdrawal rates against historical market data. A 4% withdrawal rate from a balanced portfolio (typically 50% stocks, 50% bonds) lasted at least 30 years in 96% of scenarios.

It’s not a guarantee—but it’s a powerful starting point.

A Shift in Perspective

I started talking differently.

Not about promotions or raises, but about freedom. About what life could look like if I didn’t have to work just to survive. About being able to pick up my kids from school every day. About taking care of aging parents without asking for time off. About slowing down.

I realized something profound:

Retirement isn’t about age. It’s about options.

If my investments could cover my expenses, I wouldn’t need to work. I could choose to. Or not. That was the difference between surviving and thriving.

Rethinking “Enough”

I looked at our spending. The subscriptions I didn’t use. The impulse buys. The meals out that didn’t bring joy. Slowly, I began to trim—not out of scarcity, but out of purpose.

I wasn’t depriving ourselves. I was buying something far more valuable: time.

I started investing more intentionally. Learning about index funds. Opening accounts I’d ignored for years. Tracking our net worth like a game—not to win, but to understand.

And as the months passed, our mindset shifted.

The Takeaway

This wasn’t a story about wealth.

It was a story about clarity.

The 4% Rule gave me a framework. But what really changed was the definition of success. It wasn’t about having more—it was about needing less, and living more.

And in my quiet house, surrounded by cereal bowls and papers, i began to rewrite my future—not with spreadsheets, but with intention.

Your Turn

What would your life look like if money wasn’t the main driver?

Would you travel more? Volunteer? Spend more time with family?

Financial independence isn’t just about quitting your job—it’s about reclaiming your time and aligning your life with what truly matters.

So ask yourself:

What does “enough” look like for you?

Not someday. Not when the kids are grown.

Now.

Try our Financial Independence Calculator below.

Ready to Take the Next Step?

Just like the family in this story, you don’t need millions to start dreaming differently.

If this resonated with you and you're curious about your own path to financial independence, I’m offering a free, no-obligation financial consultation. We’ll talk about your goals, your numbers, and how the 4% Rule could apply to your life.

No pressure. Just clarity.

Email/Call: felix.diaz@forthrightltd.com | 403-498-4775

or leave us a message below